Choosing the best wealth management is a process, and you should do some research to ensure you’re making the best choice. There are so many options out there, and you want to make sure you’re getting the best possible service. If you’re not sure what you’re looking for, here are some suggestions:

DBS Treasures

Whether you are just starting out or have already made a name for yourself, DBS Treasures offers you exclusive investment solutions, financial products and lifestyle privileges. In addition, you get access to the DBS iWealth App, an online platform that makes it easier to manage your wealth. It is a one-stop solution for all your financial needs. You can monitor your portfolio and mortgages, access your cash, track investments and earn a 5% cashback on your Apple Pay transactions.

With the DBS Treasures NRI Savings Account, you can earn a higher interest rate than other banks. It also offers tax benefits. This account is ideal for Indians who work abroad.

BNY Melon Wealth Management

Among the largest asset managers in the world, BNY Melon Wealth Management helps high-net-worth individuals and institutions manage their assets. They also offer services to family offices and charitable gift programs. They have offices in 35 countries. Aside from their services, they offer a variety of flexible investment programs. They also provide asset and issuer servicing. They are listed on the New York stock exchange.

BNY Melon Wealth Management has been around for more than two centuries. Their roots go back to 1784 when Alexander Hamilton helped found The Bank of New York. They were originally a bank that specialized in short-term business lending. They later became a primarily wealth management firm.

BNP Paribas Wealth Management

Founded in 1860, BNP Paribas Wealth Management provides financial services and investment solutions to private and institutional investors worldwide. The firm operates as a subsidiary of BNP Paribas, a leading European banking group.

BNP Paribas offers a variety of financial services, including investment solutions, consumer checking, savings accounts, certificates of deposit, equities, institutional banking, and corporate banking. BNP Paribas is authorised by the European Central Bank and supervised by the European Central Bank, the AMF, and the French financial regulator, ACPR.

BNP Paribas Wealth Management’s global reach is evidenced by its presence in 68 countries. In the Asia Pacific region, BNP Paribas’s reach is anchored by its presence in Hong Kong, Singapore, and Taiwan.

Amundi Wealth Management

Listed on the Paris stock exchange, Amundi is one of Europe’s leading asset management companies. The firm is involved in a wide variety of investment management activities, including mutual funds, ETFs, real assets, and alternative investments. In addition to its international business, Amundi has local presence in around 40 countries.

In addition to managing a substantial amount of assets, Amundi is also involved in socially responsible investing activities. It is ranked among the top ten global asset managers. It is particularly engaged in passive management as an ETF issuer and active management through mutual funds.

Amundi is one of the largest asset managers in Europe and has a local presence in close to 40 countries. The firm has assets under management of over US$2.1 trillion.

Pillar Wealth Management

Using a financial advisor to manage your assets can be a wise decision. A wealth manager can help you navigate your way through the investment maze and can offer personalized advice that will help you achieve your financial goals.

A good wealth manager will ask you about your goals and your risk tolerance. The financial advisor will then discuss the asset classes that are best suited for you. You can expect to receive advice about the best stocks and bonds, the best life insurance products, and the best ways to use tax shelters.

Investing in the right asset classes is a key component to your financial success. You need to be able to diversify your investments to protect your assets from the unexpected. You might also want to consider using a financial advisor to help you with estate planning.

Credit Suisse

Founded in Switzerland in 1856, Credit Suisse is one of the largest investment banks in the world. The firm’s wealth management arm offers personalized advice and services to wealthy clients, including estate planning.

Wealth management is a large part of the bank’s revenues. According to Credit Suisse, 60% of its business is geared towards ultra-wealthy entrepreneurs and growth markets. It offers investment advice and private banking services, among other things.

Credit Suisse has a presence in over 50 countries, including the U.S., where it offers mutual funds and alternative investments. It also provides a variety of digital tools and services, such as a private banking platform.

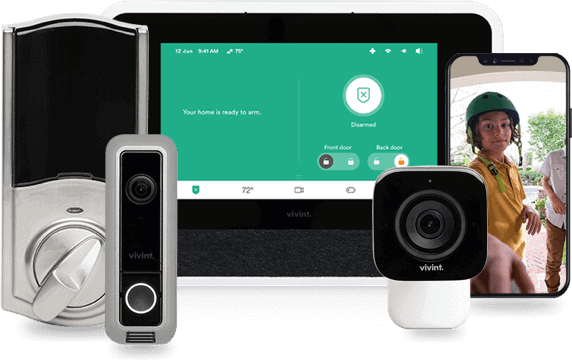

The next step is decide on the location you’d like to place the cameras. There are numerous places that security cameras are installed, so it’s vital to select the one that best fit your requirements. Then, you’ll have to determine how many cameras you’ll need. It will be contingent on your home and the amount of security you’re searching for. After you’ve selected the best security camera system to meet your requirements, it’s crucial to install it by professionals. The professional will make sure that the camera is installed correctly and that it operates properly.

The next step is decide on the location you’d like to place the cameras. There are numerous places that security cameras are installed, so it’s vital to select the one that best fit your requirements. Then, you’ll have to determine how many cameras you’ll need. It will be contingent on your home and the amount of security you’re searching for. After you’ve selected the best security camera system to meet your requirements, it’s crucial to install it by professionals. The professional will make sure that the camera is installed correctly and that it operates properly.